Dealership Tips: Boost Your Sales for Tax Season

With tax season in full swing, your car dealership should prepare for the usual influx of people trading in their old vehicles and using their tax returns to put a down payment on a new or used car.

With the IRS adjusting tax brackets to account for inflation, experts predict a boost in tax refunds this year. Given that the average tax return was $2,753 last year, it’s reasonable to anticipate an increase, providing more people with funds for potential down payments on new or used cars.

So how can your dealership prepare for this tax season?

Maximizing Marketing Opportunities

With tax season providing the highest positive cash flow days of the year for most households, people not saving their returns will be looking for something to spend it on. According to a GOBankingRates survey, about 8% of Americans planned to use their tax refund to “treat themselves” with major purchases, such as cars.

Consumers will be turning to their computers and phones to find the best deals for those large purchases. For your dealership, this means your advertising budget should be focused on creating positive micro-moments with potential buyers.

A micro-moment occurs “when people reflexively turn to a device … to act on a need to learn something, do something, discover something … or buy something.” These moments shape a consumer’s preferences.

Use micro-moments to your benefit by promoting deals for tax season. You can spotlight these incentives anywhere you promote your business — on your website, through Google, or in local TV and radio ads.

The more information you have available online, the more likely a potential buyer is to see and choose your dealership as the place to spend their tax return.

How to increase sales with tax season incentives:

- Drive demand with special discounted rates on older inventory.

- Make it easier for your customers to make a down payment with their estimated tax return with vendor programs.

- Create unique in-house financing or loan rates for the season to attract potential buyers with poor credit.

- Offer service deals to new and returning customers.

Reducing Risk

Tax season isn’t all sunshine and rainbows for dealerships. With people looking to buy new and used cars, they’re also looking to trade in their old vehicles. Trade-in vehicles can be risky for dealers if they don’t verify the details of the vehicle being traded.

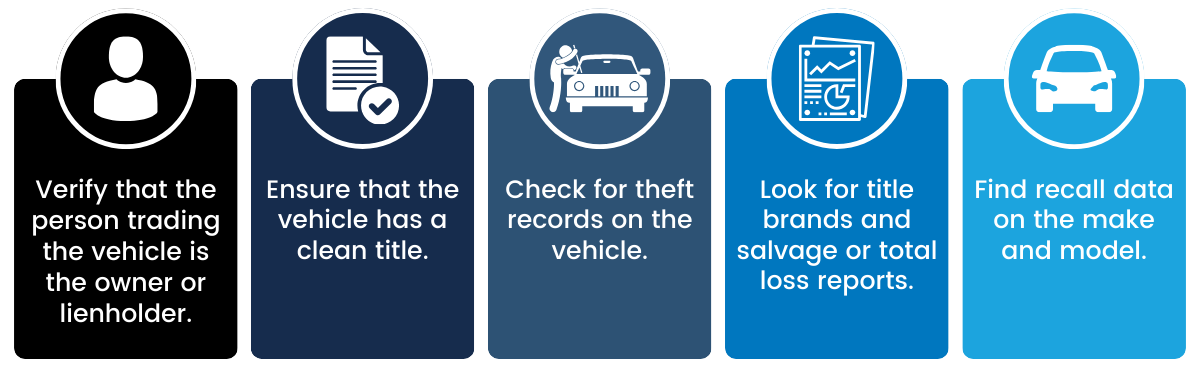

What to look out for before accepting a trade:

- Verify that the person trading the vehicle is the owner or lienholder.

- Ensure that the vehicle has a clean title.

- Check for theft records on the vehicle.

- Look for title brands and salvage or total loss reports.

- Find recall data on the make and model.

Something dealers should look out for before accepting a trade in is synthetic fraud. Synthetic fraud is a form of identity theft, and can lead to financial losses and reputational damage. One way to reduce the risk of synthetic fraud at your dealership is to access reliable and updated vehicle record databases through Auto Data Direct and government agencies.

Tax season creates opportunities for both dealerships wanting to increase their sales and people looking to treat themselves to a new car with their returns. With the right tools and incentives, your dealership can look forward to increased sales in the 2024 season and beyond!