10 Ways To Combat Synthetic Fraud

.png?width=960&height=480&name=ADDBlogStockImages%20(1).png)

Synthetic fraud, a form of identity theft, has become a growing concern across various sectors, including the auto industry. This fraudulent activity involves the creation of fictitious identities or manipulating real identities to deceive lenders, dealerships, and financial institutions for personal gain. Synthetic fraud poses significant challenges for the auto industry, leading to financial losses, reputational damage, and increased scrutiny.

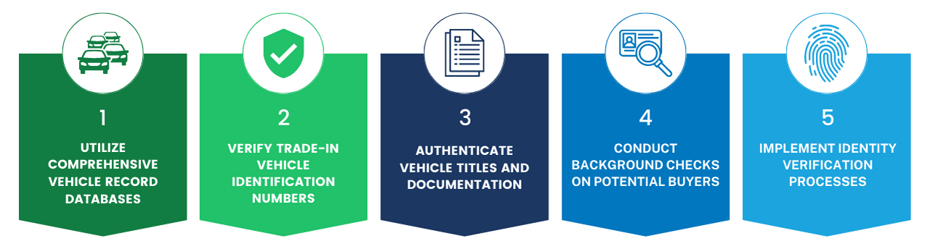

Preventing synthetic fraud at dealerships using real-time vehicle records can be an effective strategy to mitigate risks and protect against fraudulent activities. By leveraging up-to-date vehicle records and implementing robust verification processes, dealerships can minimize the chances of synthetic fraud occurring. Here are some steps and considerations to help prevent synthetic fraud:

- Utilize comprehensive vehicle record databases: Access reliable and updated vehicle record databases, such as those provided by ADD or government agencies. These databases will provide accurate information about a vehicle's history, including ownership, accident history, and title status.

- Verify Trade-in vehicle identification numbers (VINs): Before finalizing any transaction, thoroughly validate the VIN of the vehicle being traded or sold. Check it against the state vehicle record database to ensure the owner matches as well as the vehicle's make, model, and history. Any discrepancies may indicate potential fraud.

- Authenticate vehicle titles and documentation: Validate the authenticity of vehicle titles and supporting documentation. This process, again, can involve cross-referencing the information with a NMVTIS and state record search and relevant authorities, confirming the vehicle title is genuine, and checking for any signs of tampering or forgery.

- Conduct background checks on potential buyers: Perform thorough background checks on buyers, especially for high-value purchases or situations that raise suspicion. Verify the buyer's identity through reliable means, such as government-issued identification documents. In Florida, Dealers and Financial institutions should consider using ADD’s verification services like DL histories and records from our ADDTag system to confirm the buyer's identity and detect fraudulent activities.

- Implement identity verification processes: Establish stringent identity verification processes for all customers. This process may include requesting multiple forms of identification, verifying the information against reputable databases, and employing identity verification services to detect potential synthetic identities.

- Monitor for suspicious patterns: Continuously monitor transactions and customer behavior for any suspicious patterns that may indicate synthetic fraud. Look for red flags such as conflicting information, unusual buying patterns, or discrepancies between the provided information and the vehicle records.

- Train dealership staff: Educate and train dealership staff about synthetic fraud, common red flags, and best practices for verifying vehicle records. Provide them with the tools and resources to effectively identify and address potential fraud attempts.

- Collaborate with financial institutions and law enforcement: Establish partnerships with financial institutions and local law enforcement agencies to share information and collaborate in fraud prevention efforts. Report any suspected fraudulent activities promptly to the relevant authorities.

- Stay updated with industry best practices: Stay informed about emerging trends, fraud techniques, and state associations that provide training and supportive information. Regularly review and update your dealership's processes and procedures to adapt to evolving fraud schemes.

- Maintain a secure data environment: Safeguard customer information and vehicle records within a secure data environment. Implement strong security measures to protect against data breaches and unauthorized access.

By combining these preventive measures, dealers can significantly reduce the risk of synthetic fraud and create a more secure transaction environment for everyone.

Synthetic fraud presents a significant threat to the auto industry, leading to financial losses, increased costs, reputational damage, and regulatory scrutiny. These proactive measures, including advanced authentication methods, data sharing, education, compliance, and collaboration, are vital for mitigating the impact of synthetic fraud. By adopting these strategies, the auto industry can enhance fraud prevention capabilities, safeguard consumer trust, and maintain a robust and secure marketplace.